How Small Businesses Can Manage Their Cash Flow Smartly

Running a small or medium sized business anywhere in the world has its challenges. Cash flow problems in particular account for a huge percentage of corporate bankruptcies and are a major cause of financial distress in Southeast Asia, including Singapore. If sales is necessary for success, then the effective management of cash flow is key to the future of a business. It follows therefore that the focus must turn to all the activities that ensure the effective collection of debt.

Cash flow is the difference between cash received in a business’s bank account and cash going out of a business over a specific time-frame. Being able to estimate the cash cycle is important to ensure all dues can be paid on time against receipts. Yet, it is not always possible to know exactly when all the monies will arrive in the bank. One can survive in the short term without profit, but not without cash. Generating sales alone does not ensure that the business is profitable.

This becomes particularly difficult in tough economic climates such as now, where customers try to extend their cash flow resources by taking longer to pay, causing a corollary effect where every business down the chain is affected.

Therefore, cash handled by a business must be monitored through proper cash flow management. Many growing businesses find it a big headache. Cash that flows unpredictably can be as disastrous as having no cash at all.

While cash flow is a measure of the company’s ability to generate cash over a specific period of time, working capital provides a snapshot of the present situation. It is the amount of money that a company has on hand, or will have, in a given year. Working capital is calculated by subtracting current liabilities from current assets. Working capital provides an excellent idea about how a company can pay immediate liabilities. Cash flow, therefore, can be viewed as a forward-looking measure.

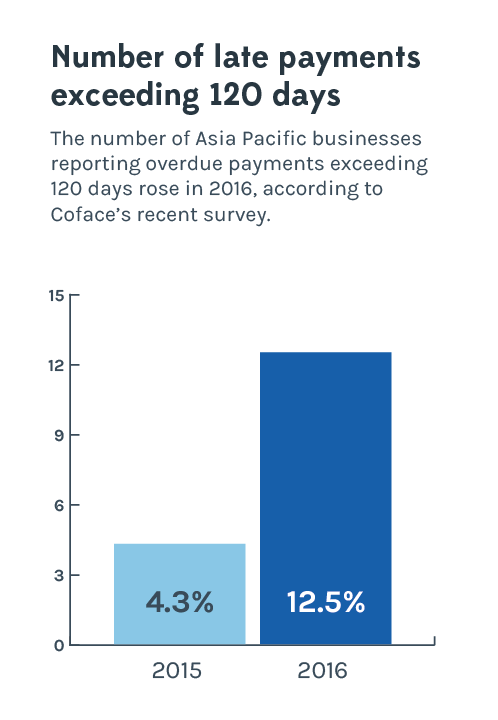

No. of late payments exceeding 120 days in 2015 and 2016

If the working capital is insufficient while cash flow is satisfactory, the company could still generate sufficient cash given enough time. However, if a company’s creditors are not willing to give required time, the company could easily go bankrupt.

Hence it is vital for a business to undertake both short-term and long-term plannings to manage its cash.

Studies done by ISCA (Institute of Singapore Chartered Accountants, Singapore) show that companies display mixed performance in its cash flow management. In general, Singapore companies fare better than their global peers in days payable outstanding (DPO) and days in inventory (DIO) but fare worse in receivables overdue and days sales outstanding (DSO).

A further recent working capital survey done by PriceWaterhouseCoopers shows the increasing DSOs across industry verticals.

There are important practices SMEs should maintain to better manage their cash flow as well as working capital.

- Have a well defined account receivable (AR) management process.

- Signing a new customer

Aligning with customers clearly on payment terms using a signed contract goes a long way in ensuring a healthy relationship. This ensures that customers know what the credit terms are and any additional costs payable, and whether interest would be charged on overdue accounts (Note: All businesses are legally entitled to do this but it is tough to execute in South-East Asia). These terms should also be clearly described on invoices you subsequently send out. Lastly if you have to follow the payment terms imposed by a customer, build the additional cost of extended credit into your prices so that your profits aren’t marginalized further.

- Invoicing

The customer should be invoiced as soon as they receive the goods or service, so at that point the cash flow time lag starts ticking. Invoicing should be done weekly or on the day the sale is made and not on a monthly basis. Most new businesses use e-Invoicing which helps in reducing the DSOs as well as lowers cost of managing the AR.

- Follow up on new accounts or large invoices

It also helps in preventing excuses for delayed payment. After dispatching goods and sending your invoice quickly afterwards, make a invoice pre-due-date call to ensure that your customer has received them and that there are no problems with the goods or services supplied, or with the content of the invoice. Invoice disputes can delay weeks or even months at times and could be due to genuine reasons.

- Monitor the accounts

Send your statements and invoices at differing times, not both at once. This can help your customers reconcile when original invoices have been lost, not received, or mislaid. Monitor key customers to understand their payment profiles. If they pay in line with credit terms, you can simply include them in the cash cycle. If they pay late, you should consider implementing new payment procedures for them. Payment terms influence potential customers, but you have to be conscious of not offering over-generous payment terms.

2. Implement credit control procedures

- Credit risk of new customers

Buy a credit report from a recognized credit reference agency; especially one that collects trade payment information on how larger companies pay their bills or work with companies like Finaxar which provides comprehensive AR management support to businesses, including payment ratings for your customers. Do not rely solely on references from a potential client regarding their payment profile. A healthy-looking balance sheet does not mean that your potential customer is very proficient in paying you. You should ensure that there is a credit limit set for each client, and that any overage is not allowed without the right permission. After all, credit limits have been set for a good reason, since you have assessed the creditworthiness of the customer and for how much your business can afford to wait (or lose, should the worst scenario occur).

- Minimize overdue customer accounts

The best option is to keep your credit current and at a minimum. However, that is not possible all the time. Constant communication with customers will allow you to identify if there are any issues sooner rather than later.

- Monitor credit worthiness of your clients

Keep abreast of news that may affect the creditworthiness of your key clients. Put their names on a monitoring service with a credit reference agency or AR management companies like Finaxar. There is nothing worse than being the last to know when something has happened to one of your key customers. Don’t fall into the trap of believing you know everything you need to know about your clients.

3. Keep a close eye on overheads and inventory

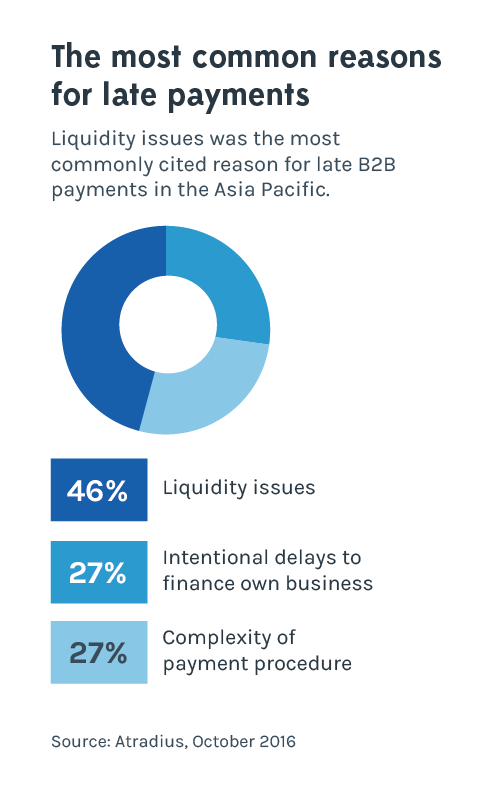

Top 3 most common reasons for late payments

Understanding the overhead cost base of your business is necessary to understand where the payments need to be made. Rooting out unnecessary expenses on a regular basis helps in eliminating excess overheads.

Inventory is necessary to fulfil sales orders on time. Likewise, there should be adequate sales to support the inventory levels. Else, it is simply cash spent that will not yet generate a return, and this will impact your cash flow negatively.

4. Manage Supplier Relationships

There is often a fine line between delayed payments to a supplier and late payments. Crossing that line and incurring extra costs for late payments is not a good cash flow management technique — it can also agitate important suppliers and potentially lead to the loss of a key supplier. Many a time, you can take advantage of credit offered by suppliers and should always negotiate for better terms rather than accepting standard terms.

There are also new Supply Chain Finance programs being created by companies like Finaxar which can help buyers avail flexible payment terms.

5. Cash flow forecasts

Forecasting is necessary to understand if your business will have the cash required to settle all its upcoming dues, and avoid stressful situations. Working closely with your financier on this can help you meet all cash flow requirements as you grow your business.

6. Understanding working capital needs

Once you have identified your cash-flow gap or working capital requirement, you need to choose between different modes of financing that are available:

- Facility types — One can go for regular Receivable Financing, Overdrafts, and Lines of Credit. These are all short term financing options. There are however, more innovative financing options which provide the flexibility of a Line of Credit, but with interest rates used in Receivable Finance. These are available from Finaxar. Finally, you also have the option to opt for long term working capital loans from banks.

- Overborrowing — The rule of thumb is that 75% of your working capital should be financed using short term financing sources such as Receivable Finance, Line of Credit, etc. and 25% using long term sources like term loans or working capital loans. This ensures you are not paying interest on monies you are not utilizing.

What we have laid here are good practices which can help small and medium sized businesses to ease their cash flow difficulties. Following these courses of action will be far better than doing nothing about slow payments, particularly from large organization, or taking extreme measures such as closing the account.

In our experience, we have noticed that large companies do not change their payment habits overnight. There will always be clients with genuine cash-flow difficulties that cannot pay up on time. Your company may not yet be big enough to employ a professional credit manager, but taking the recommended steps above will help in building a healthier cash position for your business.

© Vihang Patel.RSS